At tonight’s Reorganizational BOE meeting, we will be presenting a proposed capital project that has been previewed through a series of posts over the past week. This is the seventh and last in the series.

Today we look at a comparative analysis of the new proposed scope of work to the December 2015 proposed scope, including the average cost to the taxpayer.

In the December 2015 informational newsletter for a Capital Project Referendum that taxpayers received, readers may recall that the total project was $38,722,000. This included proposed work of $1,772,000 at Colden Elementary, $5,804,000 at Springville Elementary, $8,552,000 at Springville Middle, $21,583,000 at Springville High, and $1,061,000 in the District Office and other buildings.

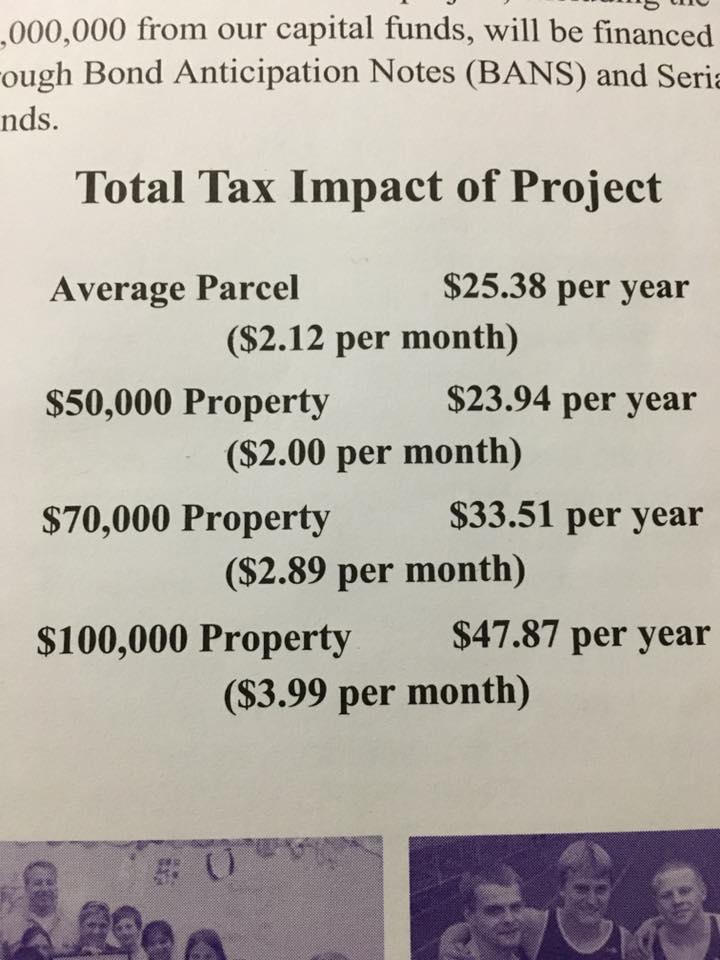

Also shown in the December 2015 Project newsletter was this average cost to the taxpayer.

The total proposed scope of work the SGI BOE will review this evening is $26,891,000, plus $1,334,000 planned for capitalized interest bringing the total project to $28,225,000. This includes proposed work of $1,552,000 at Colden Elementary, $6,527,000 at Springville Elementary, $9,517,000 at Springville Middle, $8,631,000 at Springville High, and $664,000 in the District Office and other buildings.

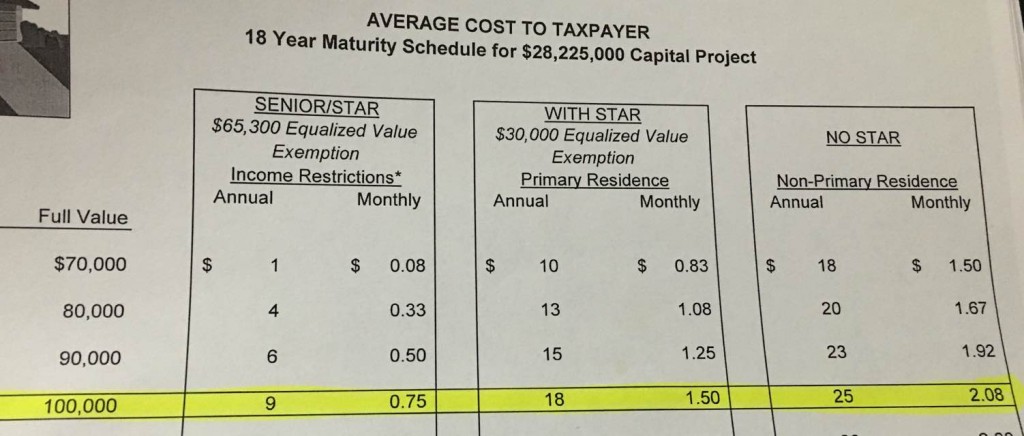

The average cost to the taxpayer for this new potential scope of work is significantly lower as you can see in the chart below, prepared for us by our financial advisory firm, Bernard P. Donegan, Inc. We’ve maximized how much of the project is aidable (only about 85% of the work at SHS would have been aidable in the December 2015 Project), we’ve included the capitalized interest in the project and we’ve scaled the project back to the work we need to do to take care of our school buildings and grounds.

Capitalized Interest allows School Districts to offset the interest expense during the construction phase of a project to minimize local impact prior to building aid commencing. Since building aid will not flow until the final cost reports are filed with SED the District will have debt service payments due without any revenue sources to offset this expense. By including Capitalized Interest in the authorization the District is able to maintain a level local share throughout the project including years in which building aid is not being received.